Alternative Data for Investment Decisions

Thanks to alternative data, investors are finding new ways to make smarter decisions.

Aura Intelligence, a pioneering workforce analytics platform, is leading this transformation. Its SaaS platform empowers investors, consultants, and businesses with unprecedented insights.

Want to leverage alternative data for smarter investments? Schedule a demo with Aura Intelligence today and see how innovative data insights can transform your decision-making.

How Alternative Data is Transforming Investment Decisions

Rather than depending solely on traditional metrics like company reports and stock prices, alternative data encompasses unique sources such as web traffic, social media sentiment, and satellite imagery. These unconventional datasets enable investors to uncover insights that traditional data might overlook.

For instance, Aura’s platform collects over 1 billion data points from public records, job ads, and online professional profiles to provide detailed workforce insights. This extensive data set and collection offers new perspectives and in-depth analysis, allowing for more informed decision-making.

The potential uses for alternative data sources are vast. Imagine tracking jet movements to predict economic activity or analyzing online reviews to gauge real-time company performance. These alternative data points provide critical, timely information that enhances investment decisions.

What Is Alternative Data for Investments?

Alternative data offers financial professionals unique insights by utilizing non-traditional sources beyond regular industry data like financial statements. It's a fast-growing market, forecasted to grow at a compound annual growth rate of 50.6% from 2024 to 2030.

Alternative Data Market Size. Graph Source: Grand View Research

Alternative Data Market Size. Graph Source: Grand View Research

Alternative Data Defined: Insights Beyond Traditional Metrics

Alternative data refers to information collected from nontraditional sources. It offers unique insights not available through traditional data sources, giving investors a competitive edge.

Unlike traditional financial reports, it includes diverse datasets such as social media activity, satellite imagery, web traffic, and workforce analytics. It offers unique insights and reveals trends not visible through conventional data sources.

Key sources include mobile app usage and IoT data from smart devices. This unique data can reveal trends and patterns not visible through conventional sources. For example, workforce analytics and labor metrics offer insights into employee behavior, productivity, and company health, getting an "outside-in" analysis of management effectiveness.

Data providers play a crucial role in aggregating and distributing this kind of data, ensuring it is accessible for analysis.

Exploring Leading Providers of Alternative Data

Using these alternative data sets has become increasingly common among hedge funds and institutional investors who seek a competitive edge in making investment decisions. These investors leverage data from various alternative data sources, such as social sentiment, satellite images, and web traffic, to analyze a company’s performance in real-time.

By incorporating these non-traditional data sets alongside traditional financial data, investors can refine their investment strategies and better predict market movements. For example, web traffic and app usage data offer insights into consumer engagement, while satellite data provides a unique perspective on supply chains and economic activities.

Alternative data can be categorized into several types, each offering distinct insights:

-

Web Traffic Data: Tracks Internet user behavior, including click-through rates, search patterns, keyword search analytics, and visit durations. It helps identify popular products and services and aids in market trend analysis.

-

Social Media Data: Monitors trends and sentiment on platforms like Twitter and Facebook. This data can show public opinion about companies and products. Social media data provides real-time sentiment analysis, reflecting public opinion on companies and products, which is crucial for timely investment decisions.

-

Satellite Imagery: Provides visual data about everything from agricultural health to retail parking lot activity, indicating company performance.

-

App Usage Data: This data captures how frequently and in what manner mobile apps are used, reflecting consumer interest and engagement.

-

IoT Data: Information collected from connected devices, such as smart home devices, fitness trackers, and industrial sensors. This data reveals usage patterns and operational efficiencies across different industries.

-

Workforce Analytics: Examines labor metrics such as employee turnover rates, productivity, and job postings, offering insights into business operations and market trends. Aura's platform uses these types of job data to offer detailed insights.

Each type of alternative data helps paint a more comprehensive picture for decision-makers, providing an edge in making informed market decisions.

Top Sources for Alternative Data: Insights from Social Media to Satellite Imagery

Top Sources for Alternative Data: Insights from Social Media to Satellite Imagery

Alternative data comes from various modern tech and non-traditional sources, such as social media interactions, credit card transactions, weather data, and even satellite imagery and geolocation data.

Online Platforms and Social Sentiment

Online platforms such as social media and review sites offer rich data on consumer opinions. Social sentiment data includes analyzing posts, comments, likes, and shares on Twitter, Facebook, and Instagram.

This data helps investors predict market trends by understanding public perceptions of products and companies. Tools like sentiment analysis software can measure positive or negative sentiments in real-time.

Additionally, product reviews and ratings on e-commerce websites can offer insights into consumer satisfaction and product performance.

Alternative Data Generated by Financial Transactions and Credit Card Data

Alternative data providers play a crucial role in transforming raw data into a usable format for financial analysis. These top alternative data providers aggregate and curate diverse datasets, including credit transaction data, government contracts, and social media posts, ensuring the information is relevant and actionable. Data scientists play a key role in this process, using sophisticated algorithms to analyze large data sets and extract meaningful insights. As a result, businesses and financial institutions can access a wide range of alternative data that supports thorough due diligence and risk management.

Financial transaction data, especially from credit card purchases and creditworthiness, is valuable. Data from Point of Sale (POS) terminals is collected and aggregated to show spending behaviors, providing a granular view of consumer spending patterns that help investors make informed decisions.

Investors use this data to track sales trends and gauge the financial performance of retail chains. For example, credit card data can reveal the frequency and amount of money spent on certain products or services.

This information provides a granular view of consumer spending patterns, helping investors make informed decisions.

Geo-Location and Satellite Data

Geo-location data from smartphones or IoT devices offers precise information on individuals' movements and locations. This data can be used to analyze foot traffic in retail stores or other businesses. Marketers spend over $17 billion annually on geotargeted mobile ads, and financial institutions can use the same for alternative perspectives for investing.

Meanwhile, satellite data provides a bird's-eye view of various activities on Earth, including agricultural yields, shipping routes, and urban development.

This data is collected through sensors on satellites and can reveal valuable insights into business processes for sectors such as agriculture, real estate, and logistics. For example, satellite imagery can help predict crop yields by monitoring plant health from space.

.png?width=250&height=250&name=Data%20Reports%20Illustration%20(1).png) How Alternative Data Enhances Investment Strategies

How Alternative Data Enhances Investment Strategies

As alternative data continues to gain traction, its integration into business processes and financial analysis is becoming more sophisticated. Financial institutions, from hedge funds to sell-side firms, can now use alternative data to identify new investment opportunities that were previously invisible through traditional sources like financial statements and company filings.

By monitoring new data sources such as satellite imagery and trading volumes, investors can stay ahead of the market and make more informed investment decisions. This proactive management approach enhances financial returns and mitigates risks associated with rapidly changing market conditions.

Alternative data is increasingly integrated into investment strategies to enhance alpha generation and optimize performance across various investor types and funds.

Integrating Alternative Data into Hedge Fund and Mutual Fund Strategies

Hedge funds often pioneer using alternative data to gain a competitive edge. In fact, 65% of hedge funds employ alternative data. They employ data from social media, satellite imagery, and weather reports to detect market trends before traditional data signals.

By integrating these data sets, hedge funds aim to uncover investment opportunities, generate alpha, and improve performance. For example, Aura's clients have leveraged its workforce analytics to make more informed strategic decisions, improving investment outcomes.

Mutual funds are also starting to use alternative data. Though traditionally more conservative, they recognize the potential for enhanced insights. This helps them better manage risk and return for their investors. Both hedge and mutual funds benefit from alternative data by refining investment strategies.

Alternative Data’s Growing Role in Multiple Sectors

The alternative data market is rapidly growing, offering investors unparalleled opportunities to refine their investment decisions. Alternative data providers have revolutionized leveraging data, from equity research to alternative data in private equity. Hedge funds and institutional investors increasingly turn to alternative data analytics and research, including examples like mobile app alternative data and satellite imagery, to gain a competitive edge.

Top alternative data providers empower users with sophisticated alternative data platforms, enabling deeper insights into market trends and company performance. This shift is not limited to large firms; most data providers offer tiered pricing based on usage. Even retail investors can access many of the best alternative data provider services for stock market insights, ensuring they stay ahead in a competitive landscape.

Revolutionizing Investment with Alternative Data

As alternative data becomes more integrated into finance, its use cases expand beyond traditional metrics. Alternative data for investment decisions now encompasses various data sources, from real estate metrics to social media sentiment analysis, providing a broader view of market conditions.

The alternative data industry has seen significant growth, with alternative data in finance and alternative data trading becoming key components of modern investment strategies. By partnering with top alternative data providers, investors can access the most valuable alternative data sets, including financial alternative data and examples of alternative data like credit card transactions, to enhance their decision-making processes. Whether through hedge fund alternative data providers or other specific alternative asset data providers, the potential for smarter, data-driven investment is undeniable.

How Private Equity and Institutional Investors Use Alternative Data

Private equity firms and institutional investors are adopting alternative data at a growing rate. These firms use this data to evaluate potential acquisitions more accurately. They look into metrics like consumer sentiment and foot traffic around retail locations. This helps them make informed decisions and assess the real-time performance of target companies.

Institutional investors like pension funds and insurance companies are also exploring alternative data. They use it to enhance portfolio management by predicting long-term trends, including environmental, social, and governance (ESG) factors. Implementing alternative data allows for more robust risk management and better investment outcomes.

Empowering Retail Investors with Alternative Data

Retail investors are increasingly using alternative data to inform their decisions. Online platforms provide data sets that were once only available to large funds. This includes everything from social sentiment analysis to app usage statistics. Access to such other data sets empowers individual investors to make more informed choices.

Apps and services offering alternative data make monitoring stocks and market trends easier for retail investors. They can align their strategies with those of larger institutional investors. This democratization of data enables retail investors to participate more actively in the market, potentially improving their investment performance.

Mastering Data Collection and Processing for Investment Insights

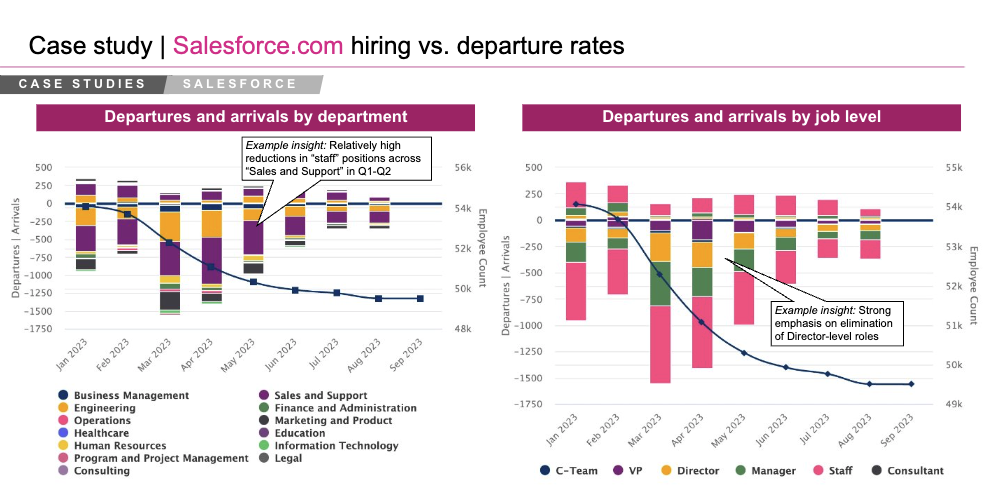

Sample Company Analysis using Aura Workforce Analytics

Data collection and processing involve key techniques such as web scraping, curating and cleaning datasets, and using various analytical tools. Understanding these methods is essential for effective data analysis and machine learning applications.

Web Scraping and Data Harvesting

Web scraping is the technique of extracting large amounts of data from websites. It involves using automated bots to fetch data from web pages. This data can come in different forms, such as text, images, or tables.

For an example of how investors might use web scraping, during the COVID pandemic, used car prices and the stock prices of online dealerships like Carvana (CVNA) soared. As the effects of the pandemic subsided, Carvana’s stock fell 89% from its 2021 peak.

Tools like Beautiful Soup and Scrapy are popular for web scraping, but do require technical expertise. These tools help parse HTML and extract relevant information effectively. Web scraping can be resource-intensive, and it should be noted that it is crucial to follow the website's rules to avoid legal issues.

Curating and Cleaning Datasets

Curating and cleaning datasets are crucial steps in ensuring data quality, but again, can prove to be time-intensive and technical. Data collected from different sources often contain errors, missing values, or duplicates, making it unreliable for analysis.

Data cleaning involves removing or fixing these inconsistencies. This can be done using tools like Pandas for Python or OpenRefine. Data cleaning also includes standardizing formats and handling outliers. For instance, dates should follow a consistent format, and numerical values should be within a reasonable range.

Curating datasets means selecting high-quality data samples relevant to the task. This often involves combining multiple data sources and ensuring they adhere to common standards. Well-curated datasets improve the reliability and accuracy of machine-learning models.

Analytical Tools and Techniques

Once the datasets are ready, various analytical tools and techniques are applied to derive insights. SQL is commonly used to query databases and extract meaningful patterns. Programming languages like Python and R are preferred for more complex analysis.

Machine learning libraries like TensorFlow and Scikit-Learn offer extensive data analysis and model-building functionalities. These tools provide algorithms for classification, regression, clustering, and more.

Visualization tools such as Tableau and Matplotlib help visualize data patterns and trends. This makes it easier to communicate findings and make data-driven decisions.

Leading Alternative Data Providers and Platforms

Leading Alternative Data Providers and Platforms

The alternative data landscape is rich with established companies and innovative startups. Choosing between these data providers depends on the specific needs and scope of the business. Established industry players bring reliability and extensive datasets, while startups often offer specialized, cutting-edge solutions.

For in-person selection of data providers, there is also a thriving group of event providers that host specialized alternative data conferences to connect buyers and sellers.

Service Differentiation and Selection

Different providers offer unique features and services. Some specialize in financial data while others focus on market trends.

When selecting a provider, it's crucial to consider:

- Data Accuracy: Reliable data can significantly impact decision-making.

- Coverage: Ensure the provider covers the specific sector or market of interest.

- Technology: Advanced AI and machine learning can improve data insights.

Evaluating these factors helps businesses find the right fit and gain meaningful and actionable insights from the data.

Cost Factors and Access

Accessing alternative data can vary in cost. Providers offer differing pricing models, such as subscription-based services, pay-per-use, or data utilization options. At Aura, we offer both subscription and utilization consumption and costing models.

Costs for alt data typically depend on:

- Volume of Data: More extensive datasets typically cost more.

- Data Granularity: Detailed, high-resolution datasets usually come with a premium.

- Access Frequency: Regular updates or real-time feeds can increase costs.

Businesses must balance budget constraints with the need for quality data. Seeking providers with flexible pricing can help manage costs and risk while ensuring access to valuable insights.

Integrating Alternative Data into Business Operations

Using alternative data can transform businesses' decisions, from refining products to understanding market trends, and offers actionable insights.

Optimizing Product and Service Offerings

Businesses can use alternative data to improve their products and services. By analyzing data like social media trends and customer feedback, companies can identify what consumers want, which helps them create products that meet current demands.

Retailers, for example, can track online shopping patterns, see which products are popular, and adjust their inventory. Similarly, financial institutions can use transaction data to offer tailored financial products.

Using customer data allows companies to predict future needs. This proactive approach ensures that businesses stay one step ahead of the competition.

Market Trend Analysis and Consumer Behavior

Understanding market trends is crucial for any business. Alternative data provides a deeper insight into these trends.

For example, firms can track foot and web traffic to see which products are gaining popularity. This information is valuable for launching new products or entering new markets. Businesses can also study consumer behavior by analyzing purchase data and online reviews.

By understanding what drives consumer decisions, companies can make informed choices, which can help them capture market share and improve customer satisfaction.

Influencing Marketing Strategies and Investor Relations

Alternative data is a powerful tool for shaping marketing strategies. By studying data like social media interactions and sales trends, marketers can create effective campaigns. They can target specific demographics, ensuring their message reaches the right audience.

This data also influences investor relations. Corporations can use data to showcase their market position in marketing presentations. Investors are more likely to support companies that demonstrate growth through data-driven strategies.

In addition, alternative data helps monitor market sentiment. Businesses can gauge public perception by analyzing news articles, press releases, and social media posts, which helps them make timely adjustments to maintain a positive image.

The Future of Alternative Data: Trends and Market Growth

- As mentioned previously, the alternative data market is rapidly growing. One source estimates that it will reach $273 billion by 2032, driven by innovations in data generation, the expansion of IoT, and the use of real-time predictive analytics and AI.

Innovations in Data Generation and Machine Learning

Advancements in data generation and machine learning are revolutionizing the alternative data market. Companies are creating vast amounts of data from sources like satellite imagery and geo-location data.

Machine learning algorithms can detangle this complex data to uncover patterns and insights that were previously impossible to detect.

Businesses increasingly leverage email receipts, credit card transactions, and other non-traditional data sources. These innovations enable better decision-making and provide a competitive edge.

Transform Investments with Aura's Alternative Data Solutions

Ready to gain a competitive edge with alternative data? Book your demo with Aura Intelligence today and discover how actionable insights can revolutionize your investment strategies.

.webp?width=1200&height=800&name=investment%20(1).webp)