Maximize Portfolio Value with Private Equity Analytics

Venture Capital and Private Equity firms play a high-stakes game in which groundbreaking companies with untapped potential can transform entire industries. To succeed, each investment requires scrutiny.

Overlooking crucial details in valuation processes can lead to disastrous consequences, including financial setbacks, reputational damage, and legal troubles. In this context, conducting thorough, evidence-based research becomes not just a choice but an absolute imperative.

Private Equity Data Analytics: Unlocking Investment Potential

Private equity firms can unlock their full potential by leveraging data analytics to drive informed decision-making. By harnessing the power of data, PE firms can gain a deeper understanding of their portfolio companies, identify areas for improvement, and optimize their investment strategies. This, in turn, can lead to enhanced portfolio performance, increased operational efficiency, and ultimately, better returns on investment.

Data analytics allows private equity firms to move beyond traditional methods and tap into a wealth of operational data and alternative data sources. This approach enables PE firms to source deals with greater precision, identify growth opportunities, and develop actionable value-creation plans. By integrating advanced analytics solutions, private equity firms can monitor performance metrics, mitigate risks, and optimize portfolio management. The result is a more robust and competitive investment strategy that drives superior returns for limited partners.

Workforce Insights: The Key to Smarter Private Equity Decisions

Workforce analytics plays a vital role in portfolio companies, enabling them to make data-driven decisions about their most valuable asset – their workforce. By analyzing operational data, such as employee engagement, productivity, and retention rates, portfolio companies can identify trends and patterns that inform strategic decisions about talent management, training, and development. This can lead to improved employee satisfaction, reduced turnover, and increased productivity, ultimately driving business growth and profitability.

For portfolio companies, leveraging workforce analytics means gaining insights into the factors influencing employee performance and satisfaction. Companies can implement targeted interventions to enhance employee engagement and retention by understanding these dynamics. This data-driven approach improves operational efficiency and positions portfolio companies for long-term success in a competitive market.

Data-Driven Insights to Boost Private Equity Returns

Effective company research goes beyond gathering information. It involves diving into multifaceted data, consulting industry experts, untangling financial complexities, and sourcing alternative data and information from various public resources. However, it's not just about the numbers and facts; it's about understanding the true value creators behind each company—the people.

Workforce analysis is crucial in the due diligence process for Private Equity and Venture Capital firms. It provides a comprehensive understanding of workforce capabilities across functions, seniority levels, and geographical locations while also revealing gaps and opportunities for optimization. Regularly tapping into this kind of analysis allows corporations and investors to stay competitive and identify potential areas for improvement.

Aura's recently published ebook, Workforce Analytics for Venture Capital & Private Equity Firms, offers invaluable insights that empower Venture Capitalists and Private Equity firms to conduct meticulous company research on the workforce. This newfound knowledge will undoubtedly enhance the ability to make well-informed decisions.

Aura's recently published ebook, Workforce Analytics for Venture Capital & Private Equity Firms, offers invaluable insights that empower Venture Capitalists and Private Equity firms to conduct meticulous company research on the workforce. This newfound knowledge will undoubtedly enhance the ability to make well-informed decisions.

Integrating advanced data analytics into the private equity industry has transformed how PE firms manage portfolio companies and drive value creation. By leveraging data analytics, these firms can move beyond traditional methods and harness the power of operational data and alternative data sources to make data-driven decisions. This approach allows PE firms to source deals with precision, identify growth opportunities, and develop value-creation plans that are both informed and actionable. As a result, private equity funds are better equipped to enhance portfolio performance and maximize portfolio value creation, ultimately delivering superior returns to limited partners.

Private equity firms must adopt a robust data strategy to stay ahead. By embracing digital transformation and utilizing advanced analytics tools, investment professionals can gain the latest insights into portfolio company operations, enabling them to drive operational efficiencies and improve value creation.

Data-driven decisions, powered by sophisticated data analysis and data management practices, allow PE firms to effectively monitor performance metrics, mitigate risks, and optimize portfolio management. This strategic use of data and analytics strengthens portfolio companies and enhances private equity investments' overall market share and competitiveness.

Tailored Data Strategies for Private Equity Success

Investors have diverse investment strategies to choose from, varying in aggressiveness and conservatism. These strategies offer options that align with different risk appetites and financial goals. Let's explore a few popular investment strategies that can help investors navigate the world of finance and make informed decisions about their portfolios.

-

Growth Investing:

Best-suited for investors seeking long-term growth by investing in companies with high growth potential compared to the industry. These companies often reinvest profits back into the business to fuel future growth. -

Value Investing:

Value investors seek companies undervalued by the market, presenting high-return opportunities. This strategy requires thorough research to identify undervalued assets. -

Income Investing:

Designed to generate passive income, this strategy focuses on assets that provide a steady income stream, such as bonds, dividend-paying stocks, and real estate investment trusts (REITs). -

Socially Responsible Investing:

This strategy, which is gaining popularity, aims to invest in environmentally and socially responsible companies that align with investors' values and beliefs.

By utilizing workforce insights, conducting meticulous company research, and aligning investment strategies with specific goals, investors can make informed decisions and stay ahead of the competition. With Aura's ebook as a guide, Venture Capitalists and Private Equity firms can reach a new level of understanding and enhance their ability to navigate the complex investment landscape.

The success of private equity analytics hinges on the collaboration between key stakeholders, including deal teams, data analytics experts, and portfolio company management. Encouraging collaboration across these groups elevates the firm's data literacy, allowing for more effective use of data assets and a deeper understanding of market dynamics.

As a result, private equity PE firms can better navigate the diligence process, identify potential creation opportunities, and align their investment strategies with broader business goals. This holistic approach to leveraging data in private equity encourages smarter decision-making and fosters sustainable value creation.

Emerging Trends in Private Markets Analytics

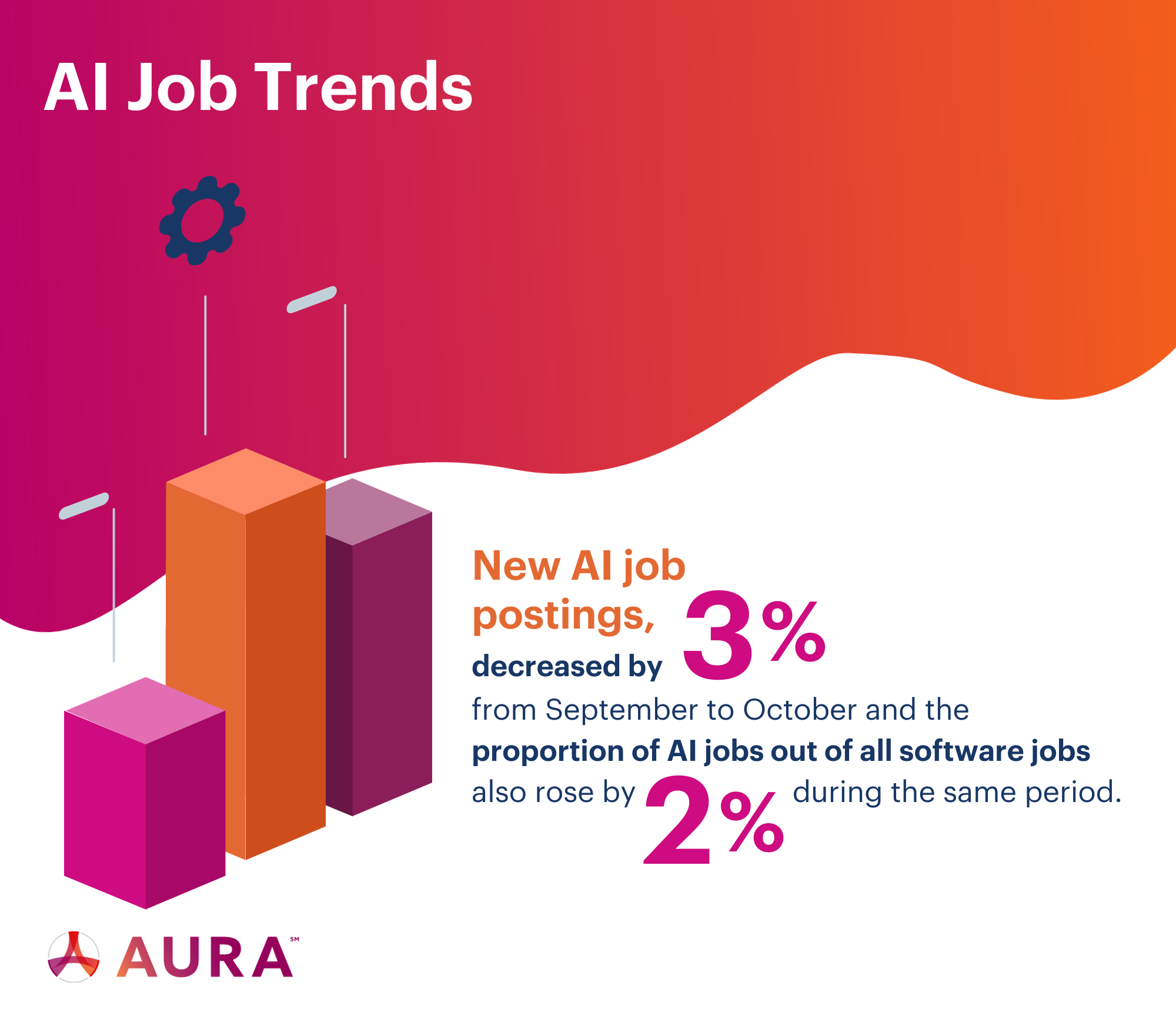

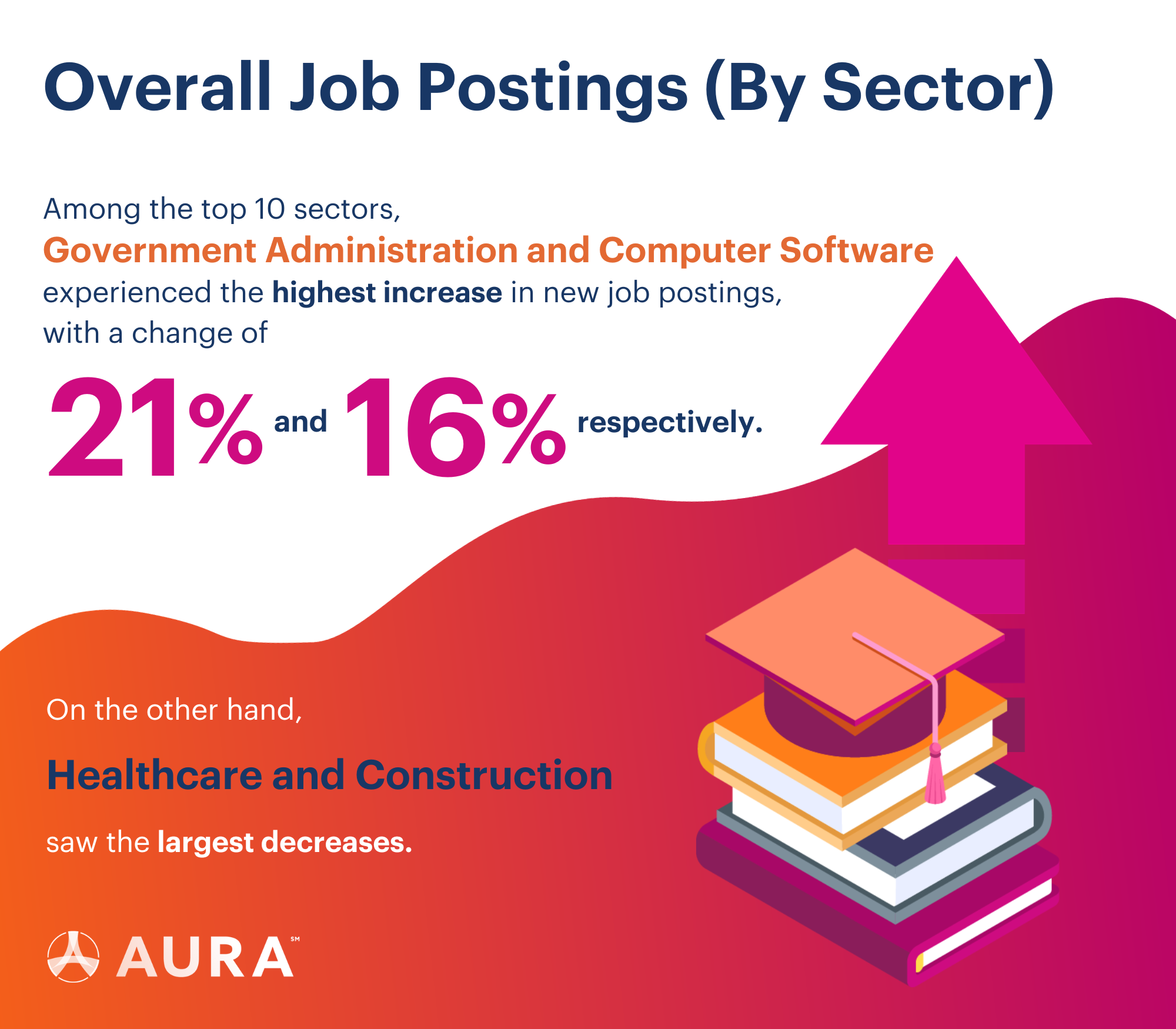

Accessing the latest hiring data provides valuable insights into recruitment trends. Aura, our advanced platform, examines publicly accessible job postings monthly to identify shifts in geography and sectors. It also uncovers specific skill and job attribute trends, such as AI and remote work opportunities. These insights offer strategic guidance for your next career move. For example, let's dive into some highlights from Aura's October job report:

Conducting Research on Industry Trends in Private Equity

Thorough research is crucial when searching for promising sectors or industries. Explore relevant data and statistics to understand the growth potential, company reputation, and management team. Analyzing current trends and upcoming developments will help you identify stable industries and those with growth opportunities.

At Aura, we excel in aggregating real-time industry data, providing a panoramic view of evolving sectors. Our platform collects and analyzes trends across workforce characteristics such as flow, skills, sources, and job postings. For instance, we recently explored the impact of AI advancements and subsequent Entertainment strikes on demand for AI skills in the Entertainment Industry. By leveraging publicly available data from various sources, Aura offers valuable hiring insights for industries.

Companies create value through their people. Consider the MAANG alumni (Meta, Amazon, Apple, Netflix, and Google) in growing tech startups. These alumni have contributed to remarkable growth and success with their innovation, excellence, and deep understanding of the industry and market dynamics. Their expertise in product development, market expansion, and revenue generation has been invaluable to startups.

Workforce Growth for Startup Expansion: Strategies for Value Creation

The overall growth of the workforce, particularly in engineering and sales teams, plays a crucial role in startup expansion and market potential. By hiring employees with specialized skills, startups can enhance their products, meet market demands, attract customers, and establish partnerships. Combined with substantial funding, this showcases startups' market viability and long-term potential.

Leveraging Workforce Mobility Data Post-Layoffs

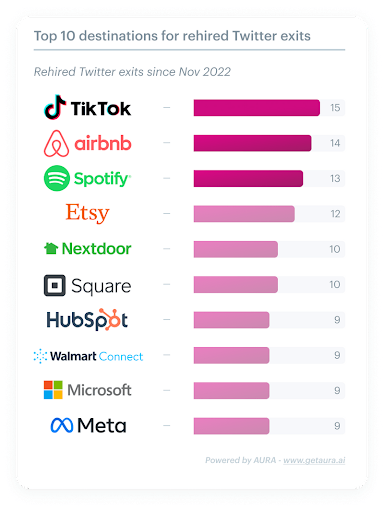

Consider Twitter's layoffs after Elon Musk's acquisition as an example. Using publicly available data up to July 2023, Aura identified 810 former Twitter employees laid off in November 2022 or later who have since taken on new roles.

The graph shows the top ten destinations for this cohort of former employees.

Studying laid-off employees' career paths and job outcomes can provide valuable insights into hiring trends and candidates' influence in securing senior positions at their new companies. Despite the negative connotations typically associated with layoffs, there are often positive outcomes as new opportunities arise elsewhere.

Aura is positioned to facilitate this analysis by providing easy access to workforce data. By comparing key metrics among different groups of companies and candidates, Aura enables a comprehensive understanding of workforce trends and empowers organizations to drive impactful change.

Driving Smarter Private Equity Investments with Workforce Analytics

The impact of technology on different industries is growing at an incredible rate. As emerging technologies become more accessible to the general population, industries that once looked stable can experience unforeseeable disruption. VC firms should keep track of technological advancements to identify potential investment opportunities.

Keep in mind that established players can initially discount disruptive trends. Some disruptive trends might emerge as a response to changes in consumer behavior that established firms cannot accommodate.

With Aura, staying informed about the technologies companies focus on becomes possible. Aura offers valuable insights into the specific technological skills that companies are actively seeking. This information can be instrumental in understanding a company's strategic direction and comparing its technological stack with industry standards.

Ready to unlock a new level of understanding in Venture Capital and Private Equity? Discover invaluable insights in Aura's ebook, Workforce Analytics for Venture Capital & Private Equity Firms. Enhance your ability to navigate the complex investment landscape and make well-informed decisions.

Take your private equity strategies to the next level. Request a consultative demo of Aura’s advanced analytics platform today and unlock the full potential of workforce insights for smarter investments.