As the July BLS report grabs headlines, Aura’s workforce data shows a deeper story of labor market rebalancing in motion.

Beneath the BLS Headlines: What July 2025 Signals About the Evolving Labor Market

Today’s jobs report surprised to the upside, with the Bureau of Labor Statistics (BLS) reporting 147,000 new jobs and unemployment dipping to 4.1%. Markets responded swiftly. The S&P 500 and Nasdaq both hit record highs following the release, buoyed by what the Wall Street Journal called "steady hiring" despite the tariff uncertainty.

But headline strength can obscure structural shifts. Aura’s workforce analytics platform, which tracks job postings and labor market activity globally, reveals a more uneven and complex picture. Hiring is not rising or falling uniformly. It’s reallocating. Some sectors are expanding, others pulling back. Some geographies are heating up, while others show signs of contraction.

Meanwhile, long-term pressure is mounting below the surface. Barron’s recently reported that U.S. net migration could turn negative in 2025, a reversal not seen since the 1960s. That shift could have profound implications for workforce availability, particularly in already tight labor segments.

One area of particular interest this month is artificial intelligence. Early-year enthusiasm led to a surge in AI-related hiring, but Aura’s data shows that momentum has cooled slightly in recent weeks as companies shift focus from headcount expansion to integration and deployment. Even so, AI continues to reshape workforce strategies across various industries, including finance, software, healthcare, and HR.

Taken together, the data points to a labor market in transition, one that is evolving, not contracting. This month’s Jobs Report unpacks that evolution across sectors, regions, and roles.

Want to explore where hiring momentum is moving and where it’s not? Request a custom demo of Aura’s workforce analytics platform and gain insights tailored to your sector, region, or portfolio.

Macroeconomic Signals: Job Gains vs. Hiring Slowdowns

The June labor market sent mixed messages depending on where you looked.

The Bureau of Labor Statistics (BLS) reported a gain of 147,000 nonfarm jobs, well above the 110,000 consensus forecast. The unemployment rate held at 4.1%, defying expectations of a rise. Markets interpreted this as confirmation that the U.S. economy remains resilient, even amid tightening financial conditions and global uncertainty around tariffs.

But ADP’s private-sector data earlier this week told a different story. According to their June report, the U.S. shed 33,000 jobs, led by losses in professional and business services and healthcare sectors, which typically serve as bellwethers for white-collar demand. Though wage growth remained stable at 4.4% for job-stayers and 6.8% for job-changers, the headline contraction suggests employers are slowing net hiring, even if they aren’t actively necessarily cutting pay and compensation.

These competing signals indicate a labor market that is not weakening uniformly, but rather bifurcating. Public sector and services jobs continue to add ballast to the top-line numbers, as the federal workforce contracted, while overall government jobs rose by 73,000. At the same time, private-sector hiring appears to be fragmenting, with some industries continuing to expand and others entering a holding pattern.

Aura’s data helps illuminate where that fragmentation is occurring and why. Watch Aura CEO, Evan Sohn, on CNBC yesterday for additional context:

Aura’s Real-Time Insight: A Labor Market in Strategic Motion

While traditional macro indicators show aggregate strength or softness, Aura’s near-real-time hiring data reveals a market undergoing selective but significant rebalancing. The labor economy is not in outright retreat, but it's certainly in motion.

Regional Job Trends: Where Hiring Is Heating Up and Where It's Cooling

North America stood out as the only major region with positive hiring momentum in June, posting a 7% increase in job postings. By contrast, Europe declined by 5% and the Asia Pacific dropped by 8%, signaling greater caution across international markets. These shifts suggest companies are reallocating headcount and resources to more stable or higher-growth geographies, rather than expanding across the board.

Country-Level Shifts: Spotlight on the U.S., U.K., and Global Contrasts

The divergence is even more pronounced at the national level. The United States and the United Kingdom each saw double-digit growth in job postings, driven by ongoing strength in healthcare, internet services, and staffing. Meanwhile, Spain, Japan, and Mexico all experienced sharp declines in job postings, reflecting local economic headwinds, demographic constraints, or post-expansion slowdowns.

Global Hiring Strategies: Policy, Demographics, and Labor Cost Impacts

These patterns reflect more than cyclical noise. They underscore how local policy, sector composition, and cost dynamics are increasingly shaping hiring strategies. Employers are not pulling back universally. They’re carefully choosing where to invest based on market fit and workforce flexibility, a trend Aura's CEO recently called "purposeful hiring" during a television interview.

Aura’s data captures these inflections in near real-time, helping clients track where labor demand is shifting and where it’s losing momentum.

Sector Spotlight: Healthcare Demand, Tech Consolidation, and Staffing Flexibility

Aura’s AI-enabled data insights on global job postings reveal where employers are signaling the strongest intent to expand headcount and where that demand is starting to slow. These posting trends provide an early indication of how companies are aligning their labor strategies with operational priorities, even before those decisions are reflected in official hiring numbers.

Healthcare: Sustained Demand Across Functions

Healthcare job postings rose by 8% in June, reflecting continued investment in both clinical and non-clinical roles. From telemedicine infrastructure to back-office operations, organizations are maintaining demand across a broad range of healthcare functions, likely a response to long-term demographic pressure and structural labor shortages in the sector.

Retail and Staffing: Frontline and Flexible Roles Lead

Retail job postings increased by 7%, indicating that employers are positioning themselves for stable consumer demand as the second half of the year approaches. Staffing and recruiting firms posted a 2% increase, typically a sign that employers are seeking flexibility, outsourcing parts of their talent acquisition process rather than committing to permanent hires too early.

These signals indicate that the labor market remains active in frontline and intermediary roles, even as executive or strategic functions decline in some sectors.

Tech and Software: Strategic Slowdown

Job postings in information technology services and software declined by 12% and 9%, respectively. These reductions likely reflect a shift from rapid team expansion to operational consolidation. Following a surge in hiring earlier this year, particularly in areas such as AI and infrastructure, many firms appear to be slowing job creation to focus on integration, deployment, and cost management.

Internet Services: A Bright Spot

Notably, internet services saw a 9% increase in job postings, indicating sustained demand for roles tied to platform growth, customer acquisition, and digital operations. This sector may be benefiting from companies investing in customer-facing capabilities even as they trim back on internal infrastructure roles.

Reallocation, Not Retrenchment

These job posting trends suggest that employers are reallocating their workforce investments, not retreating entirely. Roles tied to core operations, flexible labor, and external-facing growth continue to show strength, while back-end technical and corporate hiring is tapering.

Aura’s job posting data offers an early glimpse into these sector-specific adjustments, well before they are reflected in employment statistics or quarterly earnings. For investors, consultants, and workforce planners, tracking these demand signals is critical to anticipating where the labor market is heading next.

Remote Work in 2025: Signs of Maturity and Strategic Use

Remote job postings increased steadily through the first half of 2025, reaching a peak of 2.5 million globally in May. However, in June, both the total number and share of remote roles appeared to plateau, holding steady at around 7% of all postings.

Sector-specific developments include:

-

A 21% increase in remote healthcare roles, likely driven by growth in telehealth and digital administration

-

Slight declines in tech-related remote jobs, possibly signaling stabilization after pandemic-era surges

-

Surprisingly high growth in remote roles across market research, defense and space, and leisure travel, where remote work adoption had historically been limited

The data suggests that remote work is evolving from a pandemic-era solution to a targeted, sector-specific strategy.

AI Hiring in Mid-2025: From Headcount Surge to Strategic Deployment

In tandem with this month’s broader labor report, Aura analyzed new job posting trends tied to artificial intelligence, offering a closer look at how AI is reshaping the talent landscape.

From Surge to Strategic Slowdown

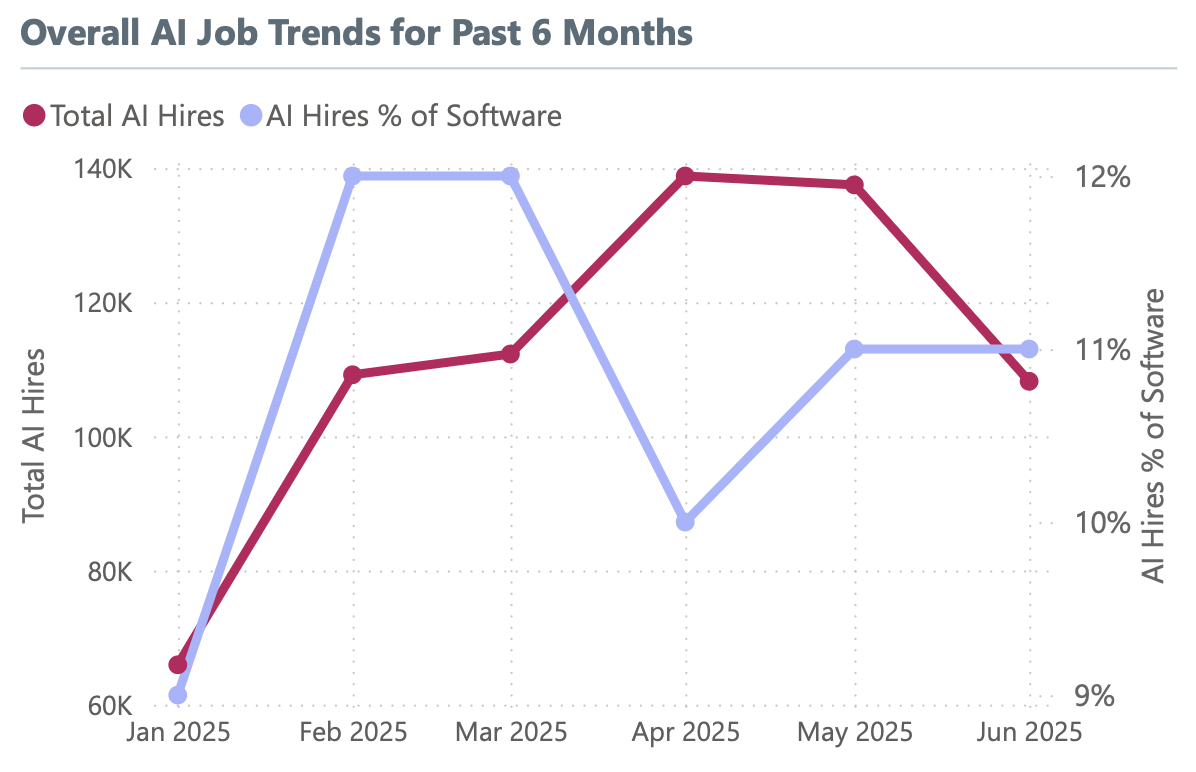

AI-related job postings more than doubled from January to April, jumping from 66,000 to nearly 139,000.

However, hiring began to taper in May and June, as companies moved from experimentation to implementation.

Despite the slowdown, AI roles still account for 10 to 12% of all software-related postings, a clear indication that AI is becoming an embedded capability, not a standalone function.

Geographic and Sector Expansion

While California and New York continue to lead in AI hiring, new growth has emerged in unexpected locations, such as Alabama, driven by incentives, infrastructure, and lower labor costs.

The top industries for AI hiring include:

-

Information Technology and Services

-

Computer Software

-

Internet

-

Staffing and Recruiting

-

Human Resources

Meanwhile, sectors such as market research experienced dips, possibly due to the maturation of AI use cases in these areas.

In-Demand Skills and Roles

Demand is particularly strong for roles in machine learning engineering, LLM fine-tuning, AI ethics, MLOps, and model evaluation. Facebook, of course, recently was in the news for reportedly offering compensation packages exceeding $10 million to secure top-tier AI talent.

This trend aligns with a broader shift toward skills-based hiring, a theme reinforced across Aura’s broader labor market data. Organizations are increasingly seeking targeted competencies rather than relying on traditional credentialing.

What These Trends Mean for Leaders, Investors, and Talent Teams

-

For consulting firms and strategists, Aura’s workforce data provides a high-fidelity view into talent markets undergoing rapid realignment. Remote adoption, sectoral rotation, and AI integration all demand new benchmarks and planning tools.

-

For private equity, the divergence between sectors and regions presents clear opportunities for talent-led value creation, M&A risk mitigation, and portfolio monitoring and optimization.

-

For enterprise HR teams, the data highlights the importance of aligning workforce capabilities with strategic objectives, particularly in areas such as AI adoption and hybrid work.

Rebalancing, Not Retreat: What Comes Next for the Labor Market?

While headlines may highlight a strong jobs report, Aura’s data reveals a more complex picture. The labor market is neither booming nor in a bust. It is rebalancing: shifting across sectors, geographies, and roles in response to changing priorities.

AI hiring, in particular, offers a clear signal of how companies are evolving. The first half of 2025 confirms that demand for AI talent is not just growing, it’s becoming foundational. Yet the focus has shifted from hype to real value, as firms prioritize implementation over experimentation.

For business leaders, consultants, and investors, understanding these shifts in real time is critical to staying ahead. Aura helps you go beyond the headlines to uncover where talent strategies are truly evolving.

Now is the time to dig deeper. Request your personalized demo of Aura to explore the hiring trends shaping tomorrow’s workforce.