Inside the 2025 Software Engineer Job Market

The software engineering job market is a dynamic ecosystem that constantly shifts in response to seasonal hiring cycles, evolving industry needs, and geographic workforce trends. Over the past six months, hiring patterns have fluctuated significantly, influenced by budget cycles, disruptions caused by AI technology, and shifting employer preferences regarding remote work.

Using Aura Intelligence’s workforce analytics data, we uncover the key hiring trends shaping the software industry in early 2025, focusing not only on absolute numbers but also on how the market is evolving over time.

Want to stay ahead in the fast-changing market environment? Access real-time workforce analytics with Aura Intelligence and make data-driven organizational and investment decisions.

Seasonal Cycles in the Software Engineer Job Market

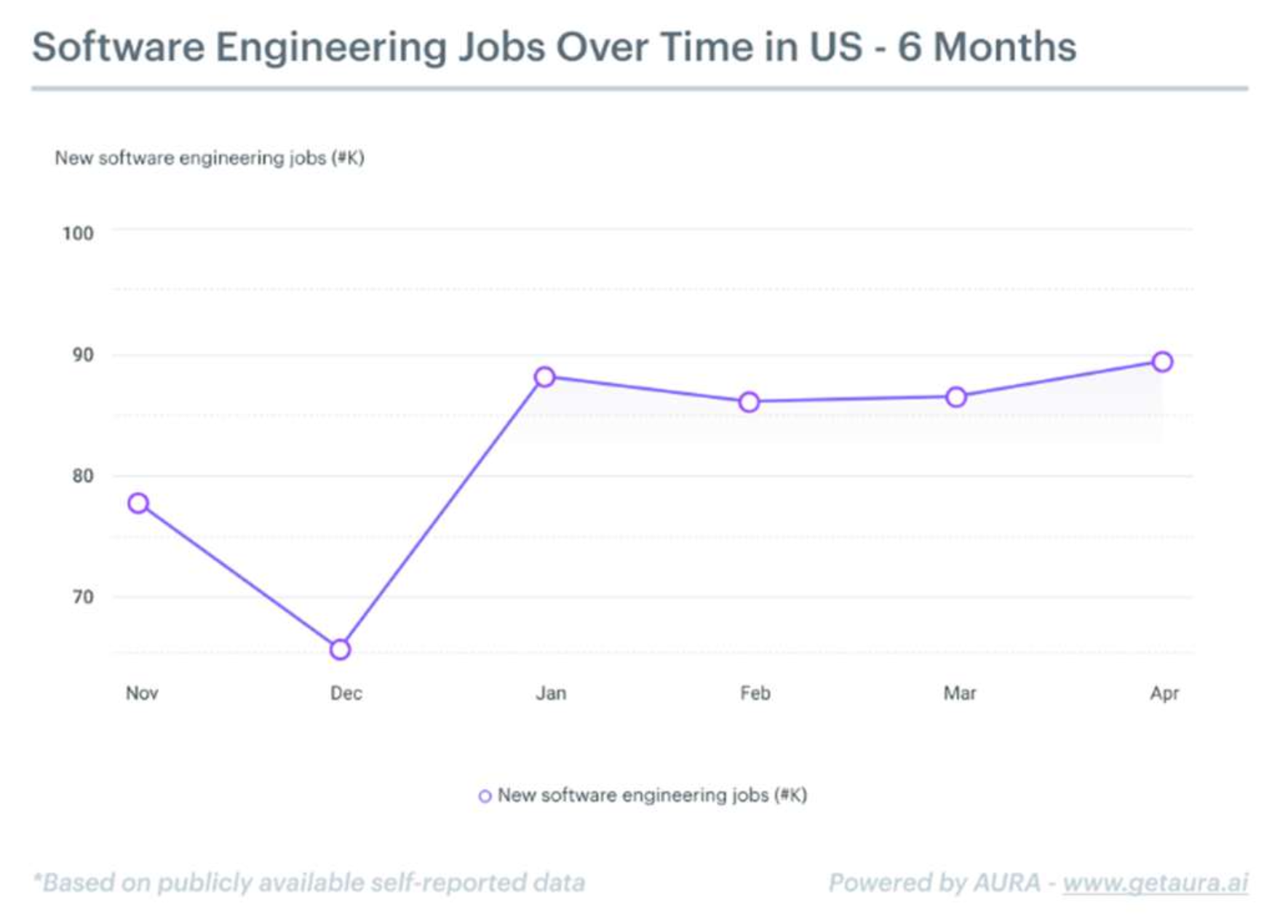

One of the most notable patterns in software engineering hiring is its cyclical nature. Over the last six months, job postings have followed these trends:

-

October & January – Hiring Peaks: Software engineering job openings hit their highest points in these months. January alone saw a sharp rebound to ~95,000 job postings after a December low of 70,000.

-

November & December – Seasonal Dips: Hiring slowed significantly toward the end of Q4, perhaps reflecting a typical corporate cycle where companies reduce hiring in preparation for year-end budgets and changes.

-

February 2025 – Mild Pullback but Overall Stability: While job postings dipped slightly from January’s surge to ~90,000, this does not seem to indicate a downturn but rather a return to a steady hiring pace.

Why the Software Engineer Job Market Follows These Hiring Patterns

-

Budget & Project Cycles: Many companies pause hiring in Q4 to align with fiscal planning and ramp up again in January when new budgets take effect.

-

Tech & Consulting Industry Trends: Firms with large tech investments and AI-driven initiatives tend to surge in hiring at the beginning of the year.

-

Seasonal Adjustments: The post-holiday hiring slowdown in December is a recurring trend, but the fact that February did not see a steep drop suggests a resilient market, at least for software engineering jobs, which bucked the overall slowing job market in February.

This chart visualizes the peaks and dips in software engineering hiring trends over the past six months (Updated May, 2025 with data through April)

Industries Driving Software Engineer Hiring Trends in 2025

Hiring in software engineering is no longer exclusive to traditional tech companies. The past few months have shown strong demand from unexpected sectors, while some industries are pulling back.

Industries Experiencing Hiring Growth

-

Investment Banking (+91%): Financial firms are aggressively hiring software engineers, likely due to the increasing automation of financial services and the rise of AI-driven trading models.

-

Industrial Automation (+73%): The demand for robotics, smart manufacturing, and AI-enhanced production is fueling tech hiring in this sector.

-

Information Services (+60%): The shift toward big data analytics, cloud computing, and AI drives demand for engineers in data-heavy industries.

Industries Facing Hiring Declines

-

Marketing & Advertising (-54%): The sharpest drop suggests a pivot away from digital marketing investments, possibly due to economic tightening and a more constrained growth environment.

-

Machinery (-51%) & Logistics (-39%): Traditional manufacturing and supply chain sectors are cutting back on software hiring, likely due to automation reducing the need for additional workforce expansion or further macro issues.

-

Computer & Network Security (-39%): Despite a growing focus on cybersecurity threats, hiring appears to be plateauing; this could indicate companies focusing on upskilling current employees rather than expanding teams.

.png?width=1244&height=808&name=3%20(8).png) This chart highlights the industries with the most significant hiring increases and decreases.

This chart highlights the industries with the most significant hiring increases and decreases.

Where Software Engineer Jobs Are Rising and Falling in 2025

.png?width=1072&height=984&name=4%20(10).png)

While California and Texas remain dominant software engineering hiring hubs, regional fluctuations suggest that some states are losing jobs while others are emerging as new tech centers.

.png?width=1244&height=808&name=6%20(7).png)

Top Hiring States (But With Mixed Trends)

.png?width=1596&height=1160&name=5%20(11).png)

-

California: Still leads the nation in absolute number of software job postings (~11,000 in February), but hiring has declined by 18% over the past month.

-

Texas: Holding steady with ~8,000 job postings, showing more stability than California.

-

New York: Flat hiring activity, indicating a mature but not shrinking market.

States Losing Software Jobs

-

Washington (-23%): The biggest drop among major tech hubs, possibly due to restructuring at large companies like Amazon and Microsoft.

-

Oregon (-21%) & California (-18%): West Coast states seeing declines in hiring.

-

Illinois & Massachusetts: Both saw double-digit declines, suggesting a potential hiring slowdown in consulting and traditional tech sectors.

States Gaining Tech Jobs

-

Hawaii (+32%): Surprisingly high growth perhaps suggesting an increase in remote-friendly and niche tech investments in the region.

-

South Dakota (+17%) & Louisiana (+15%): May reflect state-level economic incentives attracting tech firms.

-

Wyoming (+14%) & Tennessee (+14%): Growing secondary tech markets, likely pulling talent away from costlier hubs.

Remote Work in Software Engineering: Still Thriving or Slowing Down?

Remote work in software engineering is no longer in hypergrowth mode but remains a significant force in hiring strategies.

.png?width=1128&height=845&name=7%20(4).png)

-

Remote job postings hit a peak in October and December but have declined slightly since January.

-

Currently, remote roles account for about 27% of total software job postings, showing stability rather than major growth or contraction.

-

Companies seem to be adjusting hybrid work models, balancing in-office collaboration with remote flexibility.

Why Remote Job Demand is Leveling Off

-

Tech firms are emphasizing hybrid work rather than fully remote setups.

-

Companies may be prioritizing in-person collaboration for critical product and engineering teams.

-

The initial post-pandemic boom in remote hiring is stabilizing, leading to a more predictable share of remote vs. in-office roles.

AI and the Shifting Role of Software Engineers in 2025

The rise of AI-powered coding tools like GitHub Copilot has significantly altered software engineering hiring dynamics in 2025. Companies are increasingly leveraging AI to automate routine coding tasks, reducing the need for large engineering teams. This trend is particularly impacting entry-level and mid-level software engineers, as businesses prioritize professionals who can manage AI-driven workflows rather than simply write code.

As a result, hiring is shifting toward engineers with expertise in AI augmentation, system architecture, and cross-functional problem-solving. Those who fail to adapt to this new reality may find fewer traditional software engineering opportunities, reinforcing the need for continuous learning and upskilling in an AI-driven job market.

In-Demand Software Engineering Skills for 2025

Software engineers are expected to have more than just coding expertise. Recent hiring data shows a shift toward well-rounded skill sets.

Rising in Demand

-

Python & SQL: Data-driven roles continue to be in high demand.

-

Problem-Solving & Communication: Companies value engineers who can work cross-functionally.

-

Scalability & Agile Methodology: Emphasizing efficiency, adaptability, and large-scale systems.

Declining in Mentioned Requirements

-

Traditional Frontend Development: Fewer job postings are prioritizing frontend-only skill sets, suggesting a shift toward full-stack or specialized backend roles.

-

Niche Programming Languages: The focus remains on Python, SQL, and automation-related skills.

The top software engineering skills in 2025 are evolving: here’s what companies really want:

.png?width=1324&height=1160&name=10%20(1).png)

This chart outlines which skills are most frequently requested in job postings.

What’s Next in Software Engineer Hiring Trends & Career Growth

The big picture takeaway from these trends is clear:

-

Software engineering hiring is cyclical, but the long-term trajectory remains strong.

-

Tech hiring is diversifying, moving beyond Silicon Valley and into finance, automation, and regional hubs.

-

Remote work isn’t disappearing, but it’s stabilizing, suggesting companies are settling into hybrid models.

-

Skills demand is shifting toward adaptability, problem-solving, and AI-driven expertise.

For software engineers, the key to staying marketable in a competitive environment is not just technical skills, but understanding broader industry shifts. As tech hiring expands into finance, automation, and security, engineers who can adapt to these changes will be best positioned to thrive in 2025 and beyond.

.png?width=1304&height=1161&name=8%20(6).png)

This final chart shows which job roles are currently in the highest demand.

Powered by Aura Intelligence

Delivering real-time workforce analytics to help companies and job seekers stay ahead of market shifts. Learn more with a platform demonstration.