Why Private Equity and Venture Capital Firms Are Turning to Talent Flow Data

Deal sourcing has become an increasingly competitive process for private equity and venture capital firms. Identifying high-potential companies before they attract mainstream investor attention is critical to securing the best opportunities.

Traditionally, firms have relied on financial performance, market trends, and executive networks to spot rising stars. While these factors remain valuable, they provide a rearview mirror perspective rather than a forward-looking edge.

As deal sourcing shifts toward data-driven decision-making, reliance on intuition alone is fading. According to Gartner, more than 75% of venture capital and early-stage investor executive reviews will soon be informed by artificial intelligence (AI) and data analytics.

Among the most powerful emerging data sources is talent flow data—tracking who companies are hiring, where employees are going, and how workforce skills are evolving. These insights serve as leading indicators of business growth and competitive strength. Investors who integrate workforce intelligence into their sourcing strategies gain a distinct advantage over firms that rely solely on traditional financial metrics or industry networking.

Does getting a jump on the competition with an advanced organizational data platform sound good to you? Get a demo of Aura's platform and access better company and market intelligence.

![]()

Talent Flow as a Leading Indicator of Investment-Worthy Companies

Hiring patterns offer early insights into a company’s strategic direction, expansion plans, and overall market strength. By analyzing workforce trends at scale, investors can:

-

Detect high-growth companies before they appear in traditional deal pipelines

-

Assess whether an emerging company is attracting top industry talent

-

Identify hiring trends that signal increased product demand or market expansion

-

Track senior talent departures as potential red flags for operational, engagement, or cultural issues

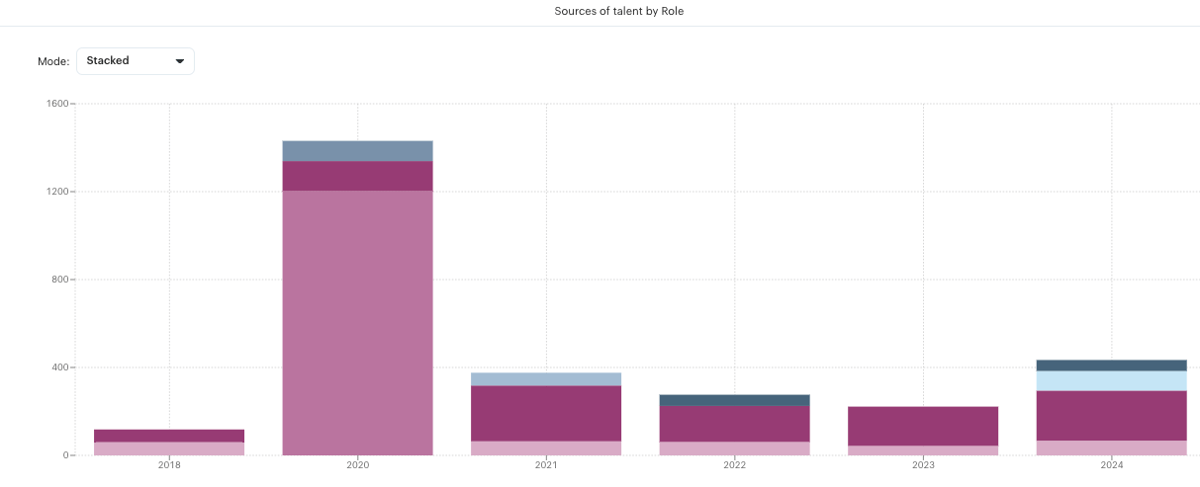

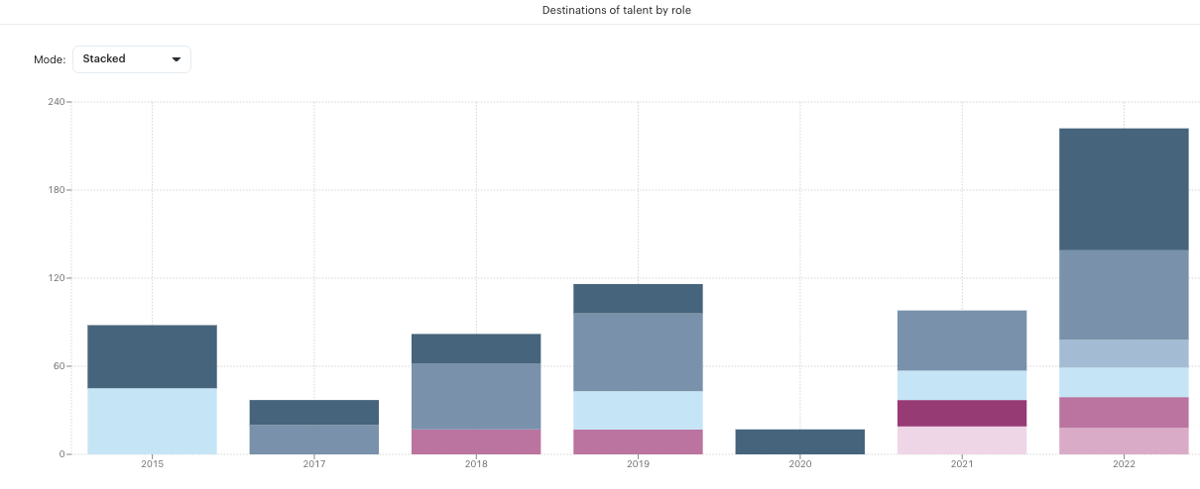

Unlike financial reports, which provide historical performance data, workforce intelligence offers real-time, predictive insights into a company’s trajectory. Aura's platform provides several talent flow reports on millions of companies, including sources and destinations of talent, as shown in the screenshots below:

Three Ways Talent Flow Data Enhances Deal Sourcing

Identifying High-Growth Startups Before They Become Competitive Targets

A common challenge for venture capital and growth-stage investors is spotting promising companies before valuations spike. Many firms wait for financial data to validate a company’s success, but by then, the best deals are often oversubscribed or priced at a premium.

Talent flow data provides early, quantifiable evidence of momentum, particularly in engineering, sales, and executive leadership roles, indicating a company is optimistic and preparing for rapid expansion.

For example, a mid-stage fintech company aggressively hiring machine learning engineers, enterprise sales executives, and regulatory specialists suggests:

-

Expansion of its product roadmap into AI-driven enterprise solutions

-

Scaling go-to-market efforts ahead of a major product launch

-

Regulatory approval processes that could signal impending industry disruption

Investment impact: Firms tracking hiring velocity in key sectors can identify and engage with breakout companies before competitors do.

Benchmarking Talent Movement to Validate Market Position

The ability to attract and retain top-tier talent with high-demand skills is a strong predictor of competitive strength. Workforce data allows investors to compare hiring trends across companies within the same industry to see who is leading and who is struggling.

Consider two cybersecurity startups at similar growth stages:

-

Company A is actively hiring security engineers away from leading firms like CrowdStrike and Palo Alto Networks.

-

Company B struggles to fill positions and sees key employees depart for competitors.

Even considering that Company is profitable and Company A is not, which one would you pick? Analyzing these patterns provides real-world evidence of which company has stronger momentum, product confidence, and long-term viability.

Investment impact: Talent movement data helps investors benchmark workforce strength and assess hiring efficiency, increasing confidence in deal selection.

Tracking Executive and Leadership Changes to Predict Market Shifts

Executive hiring and departures are often precursors to major corporate events, including IPOs, M&A activity, or internal instability. Investors who track leadership shifts and the types of skills hired for can anticipate key turning points before they become public knowledge.

-

A wave of CFO and legal hires suggests preparation for an IPO or acquisition.

-

A string of executive departures—especially to direct competitors—can indicate leadership misalignment or internal struggles.

-

Senior talent from established firms moving to a startup often signals that industry disruption is taking place.

Investment impact: By monitoring leadership movement, private equity and venture capital firms can approach companies at optimal moments—whether to invest, acquire, or reassess risk.

Why Private Equity and Venture Capital Firms Are Prioritizing Workforce Intelligence

As the private markets become more competitive, alternative data such as workforce analytics reshapes deal sourcing. Investors who incorporate workforce intelligence into their sourcing strategies can:

-

Identify emerging category leaders before their valuations spike

-

Quantify growth signals in industries where traditional financial data is limited

-

Reduce deal risk by identifying talent retention or leadership challenges early

Workforce intelligence is no longer a nice-to-have—it is a necessary tool for investors looking to gain a predictive edge in sourcing, evaluating, and closing high-value deals.

Request a Custom Talent Flow Report

Aura’s workforce and organizational insights deliver real-time hiring, attrition, and leadership movement data across millions of companies, giving private equity and venture capital firms a strategic advantage in sourcing high-growth investments.

Get the latest talent movement insights—Request a custom report.